Tesla: Leading the Electric Revolution

Tesla, Inc., a pioneering company in the design, development, manufacture, and sales of fully electric vehicles, as well as power storage and photovoltaic systems, continues to make waves in the market. With a staggering market cap exceeding $830 billion, it stands as the 8th most valuable company globally. As we approach the release of Tesla’s Q3 2023 earnings on October 18th, let’s delve into what to expect.

Impressive Production and Deliveries

In Q3 2023, Tesla showcased remarkable growth in vehicle production, reaching a total of 430,488 units, representing an 18% increase compared to the same period the previous year. Total deliveries also surged to 435,059, marking a substantial 27% year-on-year increase. Notably, the Model 3 and Model Y reported outstanding production and delivery growth, up 20% and 29% year-on-year, respectively. In contrast, the Model S and Model X experienced declines of 31% and 14% year-on-year, illustrating the changing dynamics within Tesla’s vehicle lineup. Year-to-date, Tesla’s global production exceeded 1.35 million electric cars, demonstrating a robust 45% year-on-year growth, with over 1.32 million electric cars delivered, an impressive 46% year-on-year increase.

Temporary Slowdown for Upgrades

The decline in production and deliveries during this quarter was not entirely unexpected, as Tesla had indicated temporary factory shutdowns for internal upgrades. However, despite these fluctuations, Tesla maintains its ambitious target of approximately 1.8 million units for the year 2023. Achieving this goal requires delivering around 476,000 cars in Q4, a challenge the company appears confident in overcoming.

Tesla’s Dominance in EV Sales

In the realm of electric vehicles (EVs), Tesla remains an undisputed leader, outpacing the industry’s overall growth rate of 16.3%. The US EV market has experienced consistent growth, driven by factors such as reduced pricing, improved product availability, increased inventory levels, and growing consumer acceptance of EVs. According to Cox Automotive, total EV sales in the US have crossed the 300,000 mark for the first time, a significant milestone compared to just over 250,000 three years ago in 2020. Year-to-date, total EV sales have reached over 873,000, leading to optimistic projections of reaching the one million sales mark by year-end.

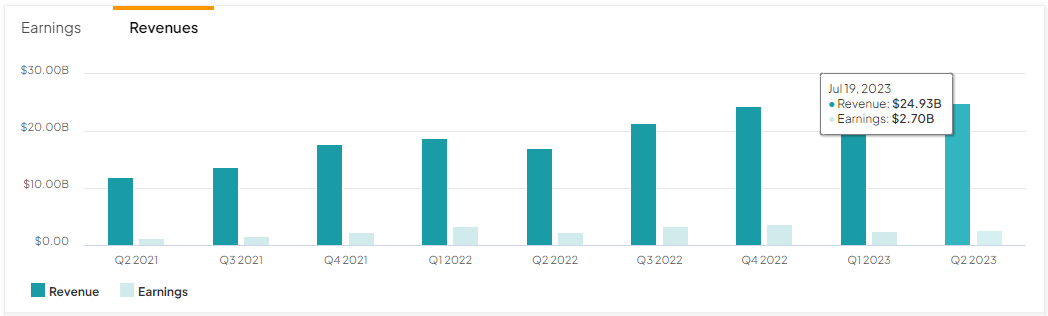

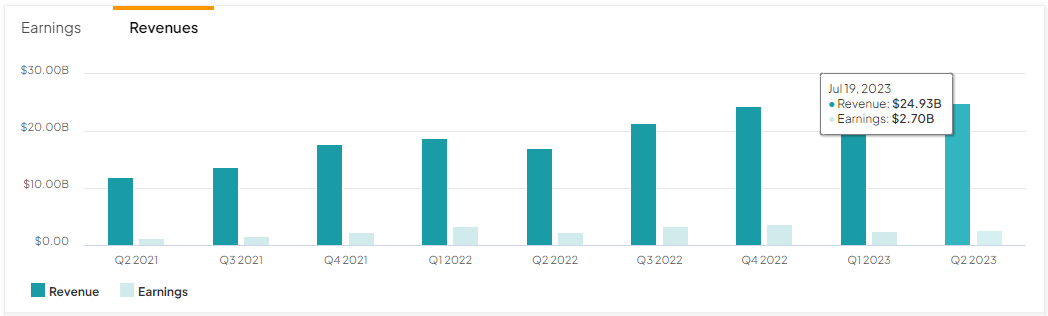

Anticipating Tesla’s Q3 Performance

As we await Tesla’s Q3 earnings report, market analysts have put forward several expectations:

– Revenue Projection: Analysts anticipate revenue to reach $24.21 billion.

– Earnings per Share (EPS): The EPS has been revised downward to $0.74 due to disappointing delivery figures.

– Gross Profit Margins: While improvements are expected, gross profit margins are likely to remain in the 18% range.

Balancing Optimism and Challenges

The current market sentiment towards Tesla appears neutral, influenced by factors like increasing competition, scrutiny over profit margins stemming from price reductions, macroeconomic uncertainties, and a forward consensus earnings ratio of over 70 times. However, there are optimists who believe in Tesla’s ability to capitalize on its streamlined supply chain, advanced battery and drive train technology, leading-edge software (including the Dojo supercomputer and AI development), and self-driving technology. They foresee Tesla continuing to be a major beneficiary of the long-term shift towards cleaner transportation and energy generation.

Technical Analysis

In the realm of technical analysis, Tesla’s stock price is currently within a symmetrical triangle on the daily chart. It is presently testing the 100-day Simple Moving Average (SMA) at around $252.70, an important level aligned with the 23.6% Fibonacci retracement from year-to-date lows to highs. Support levels to watch include the lower line of the triangle, $223.80 (38.2% Fibonacci retracement), and $200.50 (50.0% Fibonacci retracement). Conversely, a break above the upper triangle line and the Fibonacci Extension 61.8% projection at $275.60 could signal a bullish trend continuation. This might lead the stock towards its year-to-date high of $299.28 and the Fibonacci Extension 100.0% at $301.

In conclusion, Tesla’s Q3 earnings will be closely watched as the company navigates a dynamic market landscape. Optimism about its long-term prospects as a key player in the electric revolution is balanced by the challenges it faces in the short term. As the electric vehicle market continues to evolve, Tesla remains at the forefront, shaping the future of cleaner transportation and energy generation.

PAN Card Application Process: A Complete Guide A Permanent Account Number (PAN) Card is an…

Meet Samuel Edyme, Nickname - HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme…

Violet & Daisy, a captivating action-comedy directed by Geoffrey Fletcher, revolves around the lives of…

MBC's latest release, the trailer for episode 5 of "Wonderful World," showcases the captivating performances…

Deadpool 3 & Wolverine Super Bowl Trailer Easter Eggs The Deadpool 3 Super Bowl trailer…

The Nagi Nagi no Mi is a Paramecia-type Devil Fruit with the unique ability to…